As 2025 winds down, brands and retailers are bracing for one of the most competitive holiday shopping seasons yet. With shoppers buying earlier, relying on mobile, and influenced by creators, waiting until Q4 to plan is no longer an option.

Whether you’re running a fast-growing eCommerce store or juggling multiple sales channels, success during events like 11.11, Black Friday, and 12.12 starts now. It’s not just about discounts—it’s about syncing your inventory, ad strategy, creatives, and partnerships.

This guide breaks down the key moves smart brands are making today to win big 2025 sales later. Let’s get into it.

What We’ve Learned From Previous Peak Seasons

Looking back at the last few end-of-year shopping cycles, one thing is clear: consumer expectations are evolving faster than most brands can keep up. The once-reliable rush of Black Friday has now stretched into a weeks-long marathon, with shoppers starting earlier, spending smarter, and demanding more personalized, seamless experiences across every touchpoint.

In 2023 and 2024, we saw major growth in platforms like TikTok Shop and live-stream commerce, signaling a shift from search-based discovery to entertainment-led impulse buying. At the same time, economic uncertainty nudged consumers to plan ahead, compare prices aggressively, and prioritize brands that offered real value—not just flashy discounts.

Retailers that succeeded didn’t just follow trends—they anticipated them. They diversified channels, front-loaded their planning, and created compelling campaigns that blended storytelling with sharp offers. Those that waited until October to prepare? Most played catch-up the entire season.

The takeaway: what worked last year won’t be enough this year. The 2025 sales season demands a strategy rooted in data, agility, and a customer-first mindset.

Consumer Trends Shaping the 2025 Sales Season

The way people shop has shifted dramatically over the past few years—and 2025 is no exception. To make the most of the big year-end sales, brands and retailers need to align with current consumer behavior. That doesn’t mean chasing every trend blindly—it means understanding how shoppers think, where they spend their time, and what actually drives them to click “buy now.”

Short Attention Spans and Mobile-First Behavior

Today’s consumers scroll fast and decide faster. Most product discovery now happens on mobile devices, often in fragmented moments—between meetings, during commutes, or while watching TV. If your content doesn’t hook attention instantly, you’ve already lost.

Shoppers expect lightning-fast load times, clutter-free experiences, and clear value propositions. That means:

- Prioritizing mobile optimization and snappy page performance

- Keeping product descriptions digestible and scannable

- Using dynamic visuals and short-form videos to showcase features quickly

Mobile-first isn’t just a design choice anymore—it’s the lens through which purchase decisions are made.

The Rise of Social Commerce

Social platforms have quietly become the new storefronts. TikTok, Instagram, and YouTube aren’t just places to entertain anymore—they’re where discovery, influence, and purchase converge.

The TikTok Shop, for example, has reshaped how users shop by integrating product recommendations directly into content they already engage with. This form of commerce thrives on authenticity and timing.

If your brand hasn’t explored selling directly through social channels, Q4 2025 is not the time to sit it out. Key moves include:

- Partnering with creators who already speak to your audience

- Enabling seamless in-app purchases through native tools

- Planning exclusive product drops or flash deals within livestreams

Social commerce is no longer a niche—it’s a core strategy for driving impulse buys and building trust.

Generational Preferences: Gen Z and Millennials Lead the Charge

Gen Z and Millennials will dominate spending during the 2025 holiday season—and they shop differently. They care about brand values, authenticity, and personalized experiences. They’re more likely to trust a micro-influencer’s review than a polished brand ad.

For these groups, your storytelling matters as much as your pricing. They want brands that speak their language, show up in their feeds, and deliver experiences that feel curated.

To connect with them:

- Use content that feels native to the platform (not overly polished or salesy)

- Emphasize sustainability, ethics, or community impact if those align with your brand

- Offer personalized bundles, early access, or loyalty perks that make them feel seen

The brands that win in Q4 2025 will be the ones that don’t just sell—but connect.

Channel Strategy: Don’t Put All Your Eggs in One Marketplace

In today’s hyper-connected commerce environment, relying solely on one platform is a risky bet. Brands that thrived in past peak seasons were those that diversified their presence—not just in terms of where they sell, but how they engage.

Being everywhere doesn’t mean being stretched thin. It means showing up where your customer is, with the right message, and the right offer.

#1. Omnichannel vs. Multichannel

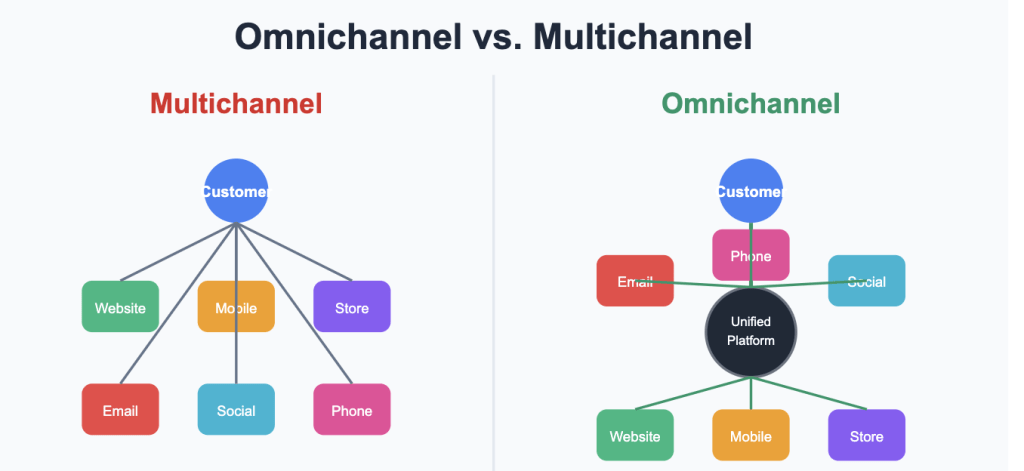

It’s tempting to treat all sales channels the same—list your products on Amazon, upload them to your website, maybe try TikTok Shop and call it a day. But that’s a multichannel strategy. Omnichannel, on the other hand, connects the dots between these touchpoints to create a seamless customer journey.

Picture this: A shopper sees your product on TikTok, visits your website to learn more, and ultimately buys from your Amazon store because of Prime delivery. That journey only works if your brand feels consistent—and available—across all those stops.

When preparing for the end-of-year sales period, an omnichannel approach ensures that no matter where your audience discovers you, you’re ready to convert.

#2. TikTok Shop, Amazon, and Your Own Site

Each platform plays a unique role in your sales ecosystem. Treating them all the same leaves opportunity on the table.

- 🛍️ TikTok Shop: Ideal for discovery and impulse purchases. Short-form video content fuels trends fast, making this a perfect place for time-sensitive promos or limited drops. Build hype, drive FOMO, and make checkout frictionless.

- 📦 Amazon: Still a top destination for transactional shoppers. Great for volume and trust—but competitive. Winning here means optimizing listings, securing reviews, and ensuring Prime-ready logistics.

- 🖥️ Your own site: It’s your sandbox. Full control over branding, pricing, upsells, and data. Invest in making it mobile-first, high-converting, and supported by retargeting and email capture.

The goal isn’t to make one channel outperform the others. It’s to make them all work together.

#3. Build Your First-Party Data Before You Need It

The brands that dominate peak season aren’t scrambling to find buyers in November—they’ve been collecting emails, phone numbers, and pixel data all year.

Use your owned channels (especially your site and email) to build first-party data you can activate during promotions. Consider offering early access, sneak peeks, or loyalty rewards in exchange for sign-ups. When ad costs spike during Q4, your warm audiences will be your safety net.

In short: think of your channel strategy like an investment portfolio. Diversify, but with purpose. Nurture your owned assets. And when the big sales hit, you’ll be everywhere your customer is—without spreading yourself too thin.

Inventory and Fulfillment: Where Most Brands Lose Margin

Inventory and fulfillment might not be the flashiest part of your sales strategy, but they’re often where the biggest profit leaks happen—especially during high-pressure sales seasons like the end-of-year rush.

When your product goes viral or your ads finally start converting, nothing kills momentum faster than the dreaded “out of stock” message. On the flip side, overestimating demand and ending up with unsold inventory in January can eat into your margins just as badly. Finding the sweet spot takes more than a gut feeling—it takes data, planning, and flexible operations.

Forecasting Smarter, Not Harder

Look back before you look ahead. Analyze past Q4 performance, taking into account year-over-year trends, promotional spikes, and customer behavior changes. Layer in external factors too—like shipping disruptions, economic shifts, or changes in platform algorithms.

Smart forecasting should also factor in:

- Product seasonality and lifecycle stage

- Return rates and historical sell-through

- Planned promotions and new product launches

If you’re launching new SKUs or entering new markets, simulate best/worst case scenarios so your stock decisions are grounded, not just optimistic.

Strengthening Your Fulfillment Backbone

Once you know what to expect, make sure your fulfillment operations are actually built to handle it.

If you’re working with a third-party logistics partner (3PL), get on the same page early. Q4 is chaotic for them, too. Share your promotional calendar, order volume forecasts, and packaging requirements well in advance.

If you’re in-house:

- Test your systems for scale: Can your tech handle surges in order volume?

- Cross-train your team to handle overflow and returns efficiently

- Set up temporary stations or overflow storage if needed

Think about speed, but also accuracy. A delayed or incorrect order during peak season can damage trust and lead to costly returns.

Diversify Your Fulfillment Options

In 2025, agility beats perfection. If possible, split inventory across multiple warehouses or fulfillment nodes to serve key regions faster. That reduces shipping times and costs—two major drivers of cart abandonment.

You can also explore hybrid fulfillment models:

- Combining in-house with a marketplace’s fulfillment (e.g., Fulfilled by Amazon)

- Using localized 3PLs for faster domestic delivery

- Partnering with dark stores or micro-fulfillment centers near major cities

The goal is to shrink the distance between your product and your customer—without shrinking your margin.

Prepare for Returns Like They’re Guaranteed

Returns spike after any big sale. Instead of dreading them, plan for them.

Clear return policies, easy-to-use labels, and dedicated processing help you recover inventory faster—and preserve the customer relationship. Bonus: Good return systems reduce the workload on your support team, which will already be swamped.

Inventory and Fulfillment: Where Most Brands Lose Margin

A great sales campaign can drive all the traffic in the world—but if your stock runs out or your delivery slows down, that momentum vanishes. Inventory and fulfillment aren’t just operational—they’re strategic. Here’s how to prepare this part of your business so it supports, not sabotages, your peak season performance.

Forecasting Isn’t Optional Anymore

Planning inventory for Q4 in 2025 requires more than just last year’s spreadsheet. Use a blend of:

- Historical Q4 performance

- Promotional plans and expected traffic spikes

- Product lifecycle insights

- Economic and market factors that might affect demand

If you’re introducing new products or targeting new channels, create several forecast scenarios (conservative, realistic, optimistic) to stay flexible.

Strengthen Your Fulfillment Game Before It’s Tested

Now is the time to test whether your fulfillment process can actually scale.

Ask:

- Can your system handle 3–5× normal volume without breaking?

- Are your fulfillment partners (3PLs, warehouses, shipping providers) looped in and ready?

- Does your team have a clear playbook for spikes, returns, and issues?

If you run in-house fulfillment, cross-training your staff, temporarily expanding capacity, and automating repeat tasks can go a long way toward smoothing the chaos.

Go Beyond One Location or One Method

A centralized fulfillment model can slow things down when orders spike nationwide.

Consider:

- Splitting inventory across warehouses closer to your top regions

- Combining in-house fulfillment with marketplace options (e.g., FBA or TikTok Fulfillment)

- Partnering with regional logistics hubs for faster last-mile delivery

This kind of agility lets you reduce shipping time and cost—two key drivers of customer satisfaction and checkout conversion.

Prepare for Returns as If They’re Guaranteed

Returns are a cost of doing business—especially after big promotions. Brands that plan for them don’t just save money—they recover it.

Key things to address:

- Make the return process clear and frictionless

- Set up fast restocking flows so returned items don’t sit idle

- Track reasons for return to catch product or sizing issues early

Returns don’t have to be a loss if you’ve built systems that turn them into second chances to impress.

Pricing & Promotions That Win: Bundles, Flash Sales, & Smart Discounts

In the heat of year-end sales, discounts alone aren’t enough. Shoppers are flooded with deals—so yours need to stand out not just on price, but on perceived value. That’s where smart promotional strategies come in.

Start by thinking beyond blanket discounts. Bundles are an easy way to increase average order value while giving customers a better deal. Curate product pairings that make sense—like complementary items or “complete-the-set” packages. It feels more thoughtful and solves multiple needs in one click.

Flash sales also drive urgency, especially when tied to limited inventory or exclusive drops. But timing is everything. Use countdown timers, early-access windows for email subscribers, or influencer-led announcements to boost visibility and action.

Still, avoid falling into the race-to-the-bottom trap. If your only tactic is slashing prices, you risk eroding brand value and profits. Instead, anchor your offers around stories—like “fan-favorite bundles,” “end-of-year must-haves,” or “giftable under $50.”

Strategic promotions aren’t just about getting clicks—they’re about earning attention and loyalty. In Q4 2025, the brands that balance creativity with value will come out on top.

Supercharged Marketing: Paid Ads, Influencer Collabs, Email & SMS

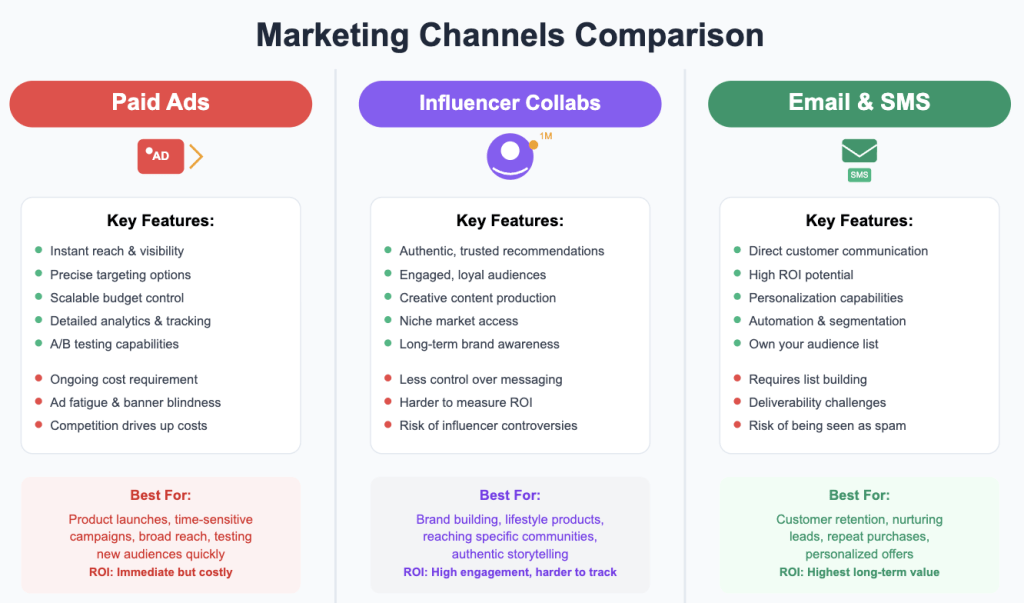

Marketing in Q4 is not just about spending big—it’s about spending smart. To cut through the noise during the year’s busiest sales season, brands need a multi-channel approach that builds momentum before the first cart is filled.

#1. Build Anticipation Early

The most successful Q4 campaigns often start in Q3. Why? Because early buzz drives early buy-in.

- Offer VIP early access to loyal customers

- Create waitlists for high-demand items

- Tease exclusive drops in your email and SMS campaigns

→ “Coming Soon” content builds curiosity

→ “Only 500 units available” builds urgency

You’re not just selling products—you’re building hype.

#2. Paid Ads

Blanket ads no longer cut it. Focus on:

- Retargeting past visitors and cart abandoners

→ These users are already warm—they just need a push - Segmenting campaigns by audience behavior and location

- Testing creatives across formats (Reels, Stories, In-Feed, YouTube Shorts)

💡Tip: Don’t wait until Black Friday to test creatives. Run A/B tests early and scale what works.

#3. Influencers & Affiliates

Creators remain key players in Q4 strategies. But don’t just chase vanity metrics—look for micro-influencers who align with your brand and drive real engagement.

How to make it work:

- Provide influencers with exclusive promo codes or early product access

- Track ROI via affiliate links

- Use their content in your own paid ads (UGC-style creative often outperforms branded visuals)

Collaborations should feel like recommendations, not advertisements. The difference? One converts better.

Test, Analyze, Repeat: Use Data to Sharpen Your Strategy

When it comes to Q4 success, gut feelings won’t cut it. You need data—real numbers—to guide your decisions and adapt quickly. The best-performing brands treat every campaign, landing page, and offer as a live experiment.

#1. Start With A/B Testing

Don’t wait for November to figure out what works.

Run A/B tests on:

- Product titles and thumbnails

- Promotional banners and headlines

- CTAs (calls-to-action) like “Buy Now” vs. “Get Yours Today”

Even small changes in layout or copy can move the needle. Gather insights early, so you can double down on what converts before the sales floodgates open.

#2. Use the Right Analytics Stack

If you’re only looking at revenue, you’re missing the full picture. Equip your team with tools to monitor:

- Traffic sources and bounce rates

- Funnel drop-offs (where are users leaving?)

- Email and SMS open rates

- ROAS (return on ad spend) by campaign

Google Analytics, Hotjar, Shopify analytics, Meta Ads Manager—each one gives a different lens. Use them in tandem to identify bottlenecks and opportunities.

#3. Be Ready to Pivot—Fast

Your Q4 plan is only as strong as your ability to adapt it.

Example: If a bundle is underperforming, repackage it. If a TikTok ad pops off unexpectedly, shift budget there.

Data shouldn’t just sit in a dashboard. It should drive action—daily. In the high-stakes game of year-end sales, speed backed by insight wins every time.

Prepare Your Team and Tech Stack

As the year-end sales rush approaches, a well-prepared team and reliable tech stack can make or break your success. Many brands pour energy into marketing and promotions but overlook the operational side—only to stumble when traffic surges or customer service requests pile up.

- Align your customer support team early. Train them on promotions, return policies, and FAQs to ensure quick, accurate responses during peak times.

- If you use outsourced support, brief them thoroughly on your Q4 campaigns, tone of voice, and expected response times.

- Stress-test your website to ensure it can handle traffic spikes without slowing down or crashing. Check load times, checkout flow, and payment gateways.

- Audit all integrations—email systems, inventory tools, shipping APIs—to make sure everything syncs smoothly and reliably.

- Set up automation to handle repetitive tasks like cart abandonment emails, shipping updates, and promotional countdowns. Test every workflow before launch.

- Prepare contingency plans for out-of-stock scenarios, tech glitches, or unexpected surges in demand. Think backup payment options, pre-written alerts, and internal escalation protocols.

A strong team and a stable tech stack won’t just help you survive the rush—they’ll let you scale it confidently and maximize every opportunity in the final stretch of 2025.

Conclusion

The final quarter of 2025 holds massive potential—but only for those who prepare with intention and agility. The brands that win won’t just be the ones offering the deepest discounts or flashiest ads. They’ll be the ones who started early, studied evolving consumer behavior, fortified their operations, and showed up with the right tools, team, and tactics. Whether you’re a growing seller or an established retailer, the time to map out your Q4 strategy is now—not in October when the rush begins. Every step you take today—auditing your site, aligning your team, refining your promotions—compounds into smoother execution and stronger sales. In a season driven by urgency, your calm, well-prepared strategy could be your biggest competitive edge.

![]()