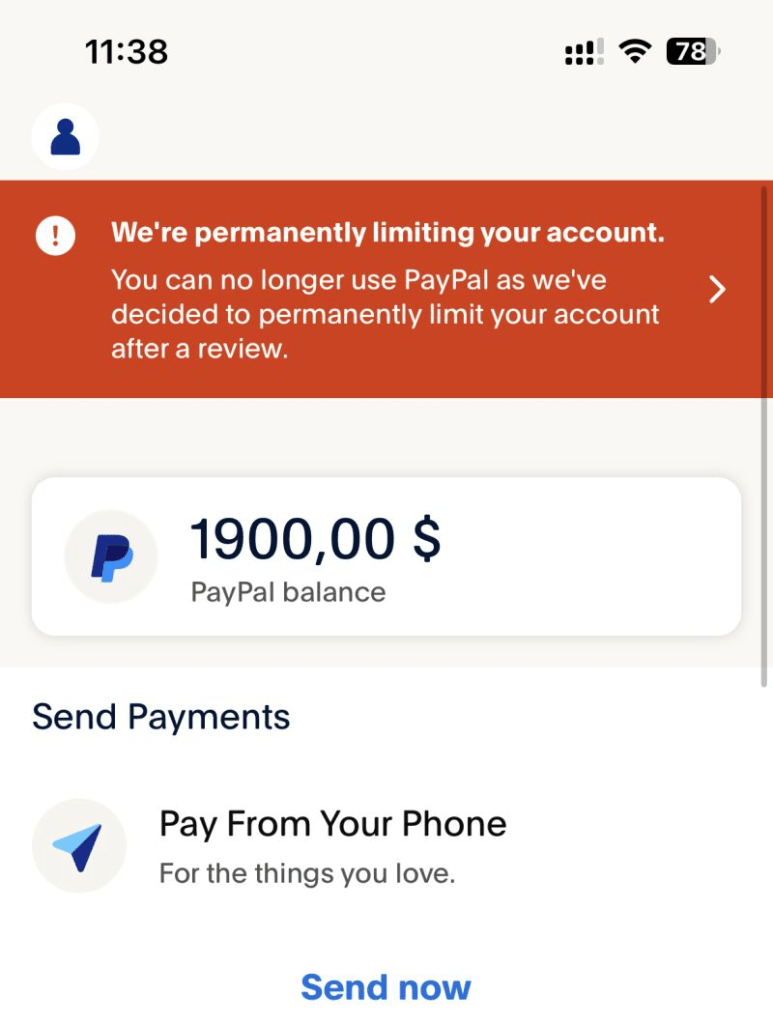

For online sellers, PayPal is more than just a payment method — it’s a vital part of running a smooth e-commerce business. But nothing sends a chill down your spine like logging into PayPal and seeing that dreaded message: “Your account has been limited.” Suddenly, your funds are frozen, transactions are restricted, and customers may go unserved.

PayPal limitations can disrupt your cash flow, delay order fulfillment, damage your brand’s reputation, and — in worst cases — permanently affect your ability to operate. The good news is: most limitations are preventable. In this comprehensive guide, you’ll learn exactly how to avoid PayPal limitations and maintain a healthy, fully operational PayPal account.

Why Does PayPal Limit Accounts?

Before we dive into prevention, let’s understand the “why.” PayPal imposes limitations to:

- Detect and prevent fraud

- Comply with legal and financial regulations (e.g., Anti-Money Laundering laws)

- Reduce disputes, chargebacks, and buyer dissatisfaction

- Investigate suspicious or unusual account activity

- Enforce its Acceptable Use Policy (AUP)

If your account raises any red flags, PayPal may instantly apply a limitation to review your activity — usually without warning. And until you resolve the issue, some or all of your PayPal features may be locked, including sending money, withdrawing funds, or receiving payments.

12 Proven Strategies to Avoid PayPal Limitations

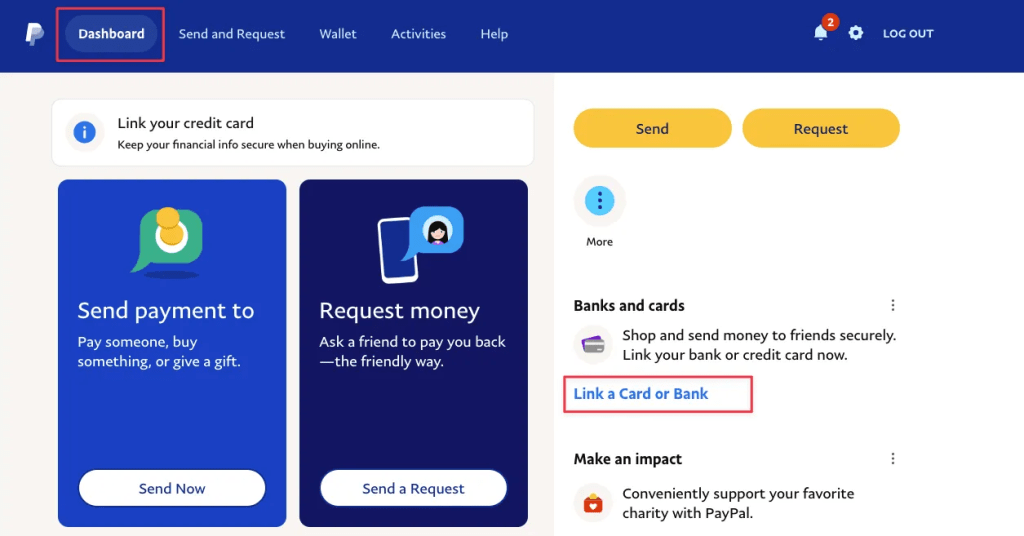

1. Fully Verify Your PayPal Account

PayPal trusts verified users more. If you’re unverified, your account is automatically flagged as higher risk. Make sure you:

- Confirm your email address

- Link and verify your bank account

- Add and confirm a credit or debit card

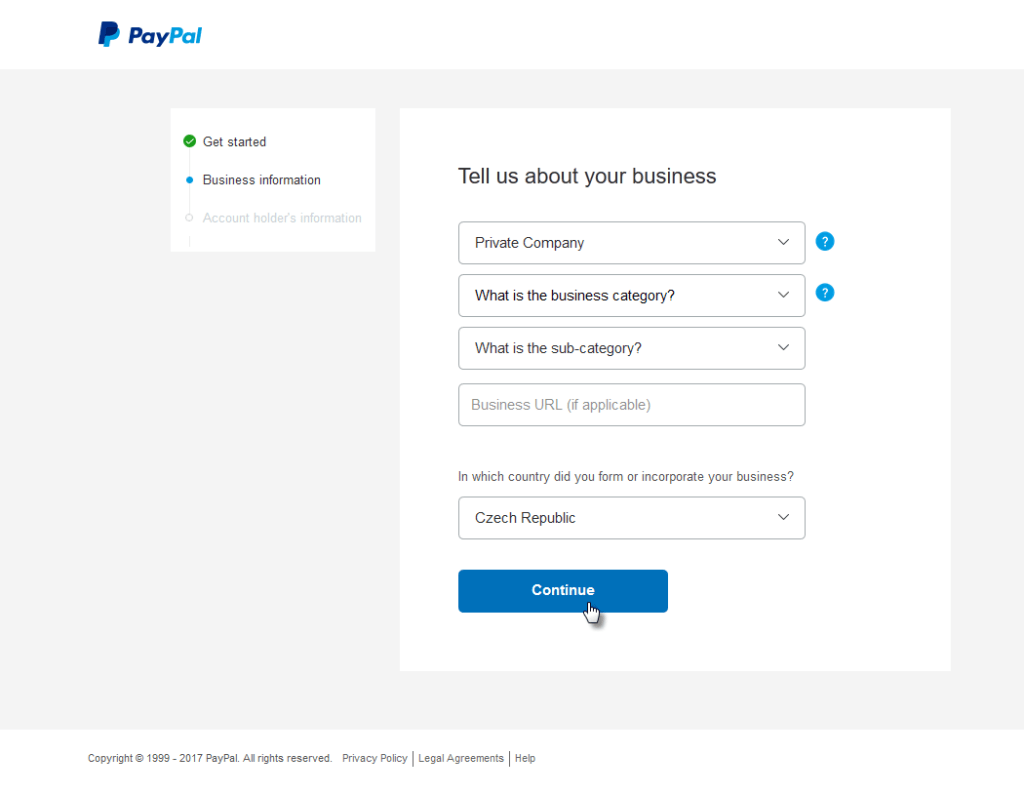

- Provide your business info and tax details (especially for Business Accounts)

Pro tip: Upgrade to a PayPal Business Account if you’re selling products or services professionally. Business accounts offer more tools, reporting, and credibility.

2. Use Consistent and Accurate Business Information

Mismatched business names, fake documents, or using a personal account for business transactions can lead to suspicion and sudden limitations.

- Use your legal name for individuals or registered company name for businesses

- Ensure your billing address, phone number, and business name match those used in your legal documents and tax filings

- If you’re a sole proprietor, still use official contact details — not nicknames or aliases

3. Avoid Logging in from Multiple Locations or VPNs

PayPal tracks IP addresses and device information to spot suspicious access. If you or your team logs in from different countries or IPs — or uses a VPN — you risk triggering a security lock.

Use a dedicated device for PayPal activities and avoid using public Wi-Fi or rotating proxies.

4. Maintain a Low Dispute, Refund, and Chargeback Rate

Too many customer complaints, refunds, or chargebacks signal that your business may be unreliable or fraudulent.

PayPal will notice and respond by limiting your account, especially if:

- You don’t respond to disputes quickly

- Customers escalate complaints to PayPal or their credit card provider

- You have a refund rate higher than 3–5% of sales

How to reduce disputes:

- Write honest, detailed product descriptions

- Provide clear shipping timelines

- Respond to customer queries within 24 hours

- Add contact info on your site for faster resolution

5. Always Upload Tracking Numbers

For physical goods, PayPal prefers sellers who provide tracking numbers. It’s one of the fastest ways to prove delivery, avoid disputes, and get funds released early.

Use well-known shipping services like:

- USPS

- UPS

- FedEx

- DHL

If you’re selling digital goods, be ready to show screenshots, email delivery logs, or confirmation from the customer.

6. Don’t Suddenly Spike Your Sales Volume

New accounts or slow-moving sellers that suddenly jump from $500 to $10,000 in sales in one week often trigger review flags.

PayPal may suspect fraud or that you’re not equipped to handle that volume — especially if you can’t provide tracking or documentation.

What to do:

- Grow steadily and scale gradually

- Notify PayPal in advance (yes, you can do this via support) if you’re launching a promotion or flash sale

- Have invoices, supplier info, and product listings ready in case PayPal asks for proof

7. Avoid Selling High-Risk or Prohibited Items

Certain items are more likely to be flagged by PayPal, including:

- Electronics

- Digital products or services

- Dropshipped goods

- Tickets, gift cards, or NFTs

- CBD, supplements, or tobacco products

- Adult content

These products often have higher dispute rates or fall into gray legal areas.

Tip: Always review PayPal’s Acceptable Use Policy before listing new products.

8. Respond Promptly to Resolution Center Requests

If PayPal limits your account, they’ll usually ask you to:

- Submit your ID

- Provide invoices or proof of inventory

- Verify your supplier

- Confirm shipping for specific transactions

Delays in responding can extend the limitation unnecessarily.

Action plan:

- Check your email and PayPal Resolution Center daily

- Upload clear and complete documents

- If you need help, call PayPal support and explain your situation politely

9. Don’t Link to Suspended or Limited Accounts

If your account shares information (IP, email, device, address, etc.) with a previously suspended account, PayPal may limit yours too.

Pro tip: Always start a new account with unique credentials and clean data. Never reuse old info from a flagged account.

10. Use Clear, Transparent Checkout and Refund Policies

Unclear return/refund policies are one of the top causes of disputes and customer confusion. Make sure your checkout page includes:

- Estimated delivery time

- Refund conditions

- Support email or phone number

- Terms and conditions

11. Monitor Account Health Regularly

Log into your PayPal dashboard at least once a week to:

- Check for alerts

- Review recent transactions

- Ensure all pending actions are resolved

12. Use Good Customer Communication and CRM Tools

Sometimes, customers file disputes just because they don’t know where their order is. Using tools like Shopify’s order update emails or automated support messages can reduce these issues significantly.

What If I Still Get Limited?

Even with your best efforts, limitations may still happen. If they do:

- Go to the Resolution Center immediately.

- Submit all documents requested — don’t wait.

- Add tracking info for pending orders.

- Call PayPal Support and explain your situation calmly and professionally.

- If denied, appeal with stronger documents and a timeline of events.

FAQs: Avoiding PayPal Limitations

Q: How long does PayPal keep your account limited?

A: It depends on the case. Most limitations are resolved in 2–5 business days once you submit proper documentation. In serious cases, it can take up to 180 days.

Q: Can I prevent PayPal from holding my funds?

A: Yes. Add tracking info, build a strong seller record, and ask buyers to confirm delivery. PayPal may release funds earlier.

Q: Can I still receive money when limited?

A: Sometimes yes, but you may not be able to withdraw funds until the issue is resolved.

Q: Should I open a second PayPal account?

A: Opening another account while your first one is limited may lead to both being suspended. Always resolve issues first.

Final Thoughts

PayPal limitations are frustrating but avoidable. As an online seller, it’s your responsibility to maintain a trustworthy, transparent, and compliant account. The key is preparation: verify everything, stay responsive, scale wisely, and treat customer service as a core part of your business.

With the 12 strategies in this guide, you’ll not only avoid PayPal limitations but build a stronger brand and enjoy faster payments, fewer disputes, and better relationships with your customers.

![]()